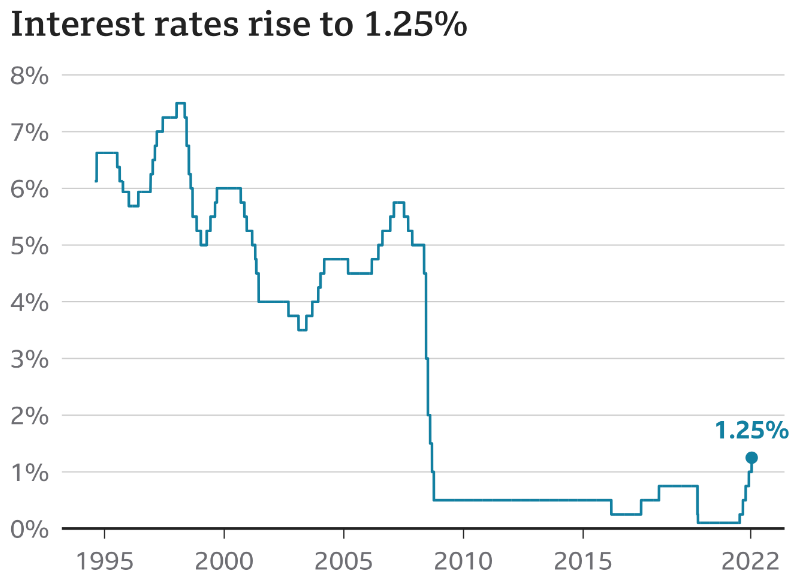

The Bank of England (BOE) have increased the interest rates this month again, June 2022, by another 0.25%. Taking the new base rate to 1.25%. This being the highest rate in over 10 years.

With many outside factors spiking the rate of inflation to a 40 year high of 9.1%, and creating a cost of living crisis, it would be prudent to think that there will be many more rises by the end of the year.

The Money Blogger believes interest rates will hit around 2.5% by the end of this year, and be around 4% by the end of 2023. If inflationary pressures do not ease by 2024, then we may have to see yet further increases to around 6%. Don’t forget, this is the BOE base rate, you wont get a mortgage deal as low as the BOE base rate, it will be usually be 1% to 2% higher than the BOE base rate.

What can I do about rising interest rates?

If you have a variable or tracker rate mortgage it might be worthwhile looking at getting a new fixed rate deal before interest rates increase even further.

As a guide, for every £100,000 borrowed, a quarter point/0.25% increase in the BOE base rates equates to an additional £10 per month on top of your mortgage payments.

Want more information on interest rate – head over to the bank of England website.

Want to see more blog posts? Seem them all HERE